The past year has seen incredible growth for our InvestED podcast – 723,000 listens worth of growth.

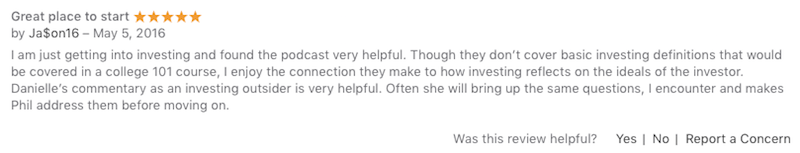

We’ve been able to cover topics from all levels of investing with my daughter, Danielle, serving as my counter balance and asking the questions a beginning investor would ask.

Here’s a screenshot of our listens as of today.

Whether you’re a seasoned investor, or you’re looking to buy your first stock, InvestED has something you can use.

We’ve covered investing across…

- Finding a competitive advantage in a business

- Real estate investing

- What to do during a stock market drop

- Growth rates

- Why price and value are different

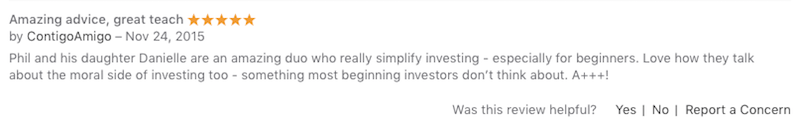

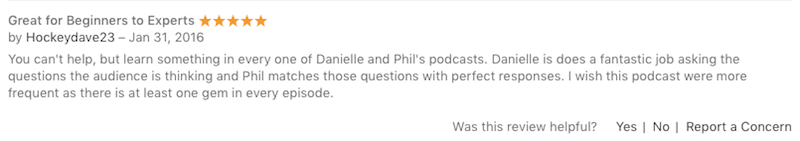

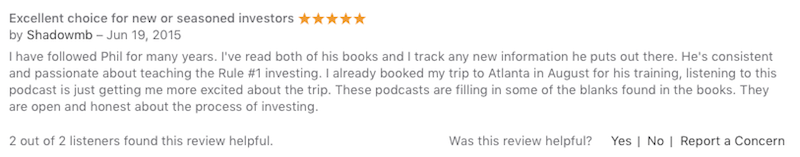

700,000+ listens is great, and one of the best parts of the podcast has been reading your reviews and hearing how much you’ve been enjoying the content.

Today I wanted to share the top 11 most listened to InvestED podcast episodes from the past year that can help you on your investing journey.

Let’s get into it…

Join My Free Online Investing Training

1) Episode 14- How to Make Your First Trade

Going back to basics. Questions like, “Where do you start making trades?” and, “What is a stock?”

In this podcast, we discuss the tools you’ll use for your first trade and the type of investment brokerage account options for the new and seasoned investor alike.

(RELATED: How to Invest $500)

2) Episode 23- Events, Margin of Safety, and Moat Numbers

Insist on buying stocks on sale. Rulers never pay full price. We discuss what it means for wonderful companies to be in an event and finding a margin of safety.

3) Episode 19- Understanding Growth Rate: Book Value Per Share Growth Rate

We discuss the importance of growth rates to judge the quality of a business.

This episode covers:

- The different financial statements.

- Investing is like learning a new language, it just takes practice.

- The important numbers on the balance sheet.

- What is Book Value?

- What is the book value per share growth rate?

- Mohnish Pabrai’s 650,000 dollar lunch.

- What are the big 4 growth rates?

4) Episode 15- The Reason Mutual Funds Aren’t Mutual

You have different options when it comes to investing. We discuss the realities of mutual funds, hedge funds, and indexes.

This episode covers:

- A look at different types of investment options such as 401K, IRA, mutual funds and hedge funds.

- The difference between mutual funds and hedge funds.

- What is the Dow Jones Industrial Average?

- How the S&P 500 affects other stocks.

- Mutual fund fee structures.

- Hedge fund fee structures.

- Learn about the myths and realities of mutual funds.

(RELATED: The Truth About Mutual Funds)

5) Episode 13- The Dhando Investor and Taking Minimal Risk

This podcast focuses on Mohnish Pabrai’s book, The Dhandho Investor. We discuss the Patel family and their innovative strategy in the motel and hotel business. They highlight the concept of value investing the way Pabrai highlights it and how to invest with minimal risk and very high upside.

(RELATED: How To Save Money And Accumulate More Wealth)

6) Episode 17- How to Read a 10-K Report

We use Whole Foods to show you what to look for in a 10-K report and why they’re so important. We go through it step-by-step so you can see exactly what it takes to understand a business.

This episode covers:

- The acronym for R.U.L.E.R.S.

- Why investing shouldn’t feel like work if you’re interested in the business.

- Why the effects of compounding over 40 years will make anyone a millionaire.

- We discuss Whole Foods and company values.

- How to research a business.

- Analyzing an individual business 10-K annual report.

- What to look for when reading 10-K reports.

(RELATED: How to Read a 10K)

7) Episode 39- What a Market Drop Means to Rule #1 Investors

In this episode, we discuss how the DOW drop affects you as a Rule #1 Investor, the new Hollywood hit “The Big Short,” and why you probably shouldn’t watch CNBC.

(RELATED: What to do During a Stock Market Drop)

8) Episode 48- Risk vs. Volatility

Does volatility mean that you’re taking more risk? This week we discuss short-term thinking vs. long-term thinking in investing and why your relationship with risk might be related to your thinking.

9) Episode 28- Dividends and Finding the Right Time to Buy a Stock

We discuss what dividends are, how they’re paid out to owners, some Econ-101, can a company be recession proof, and if you should hold off on buying stocks right now.

10) Episode 12- R.U.L.E.R.S. Rule

Phil outlines, “The Scientific Method for Investing.”

This episode covers:

- Be wary when approaching investing with a macro perspective. The world is very difficult to predict and complicated.

- What is blue pill investing = the reality pill (reference from The Matrix).

- Why when we buy a stock, we actually want the price to go down further.

- Why we start with an event.

- The definition of an event: The fear of investing in a company.

- In the long-run we know that this business is actually going to go up. This is different from hoping it will go up.

- The acronym of R.U.L.E.R.S.

- “The scientific method of investing.”

- What is a “Bear Case?”

11) Episode 62- Our 1-Year Anniversary Episode!

It’s our 1-Year Calendar Anniversary on the InvestED Podcast! One full year of learning, growing, and most importantly, laughing. Thank you all for being a part of our journey. We’re looking forward to another great year ahead of investing education. In today’s episode, we’re taking a step back to recap all of the most important things we’ve learned over the past year.

Have you subscribed to InvestED yet? If not, you can find us out on iTunes and subscribe.

To learn more about the Rule #1 strategy and how to make your first investment, check out my next live webinar (it’s about 45 minutes and it can change your life).

Phil Town is an investment advisor, hedge fund manager, 3x NY Times Best-Selling Author, ex-Grand Canyon river guide, and former Lieutenant in the US Army Special Forces. He and his wife, Melissa, share a passion for horses, polo, and eventing. Phil’s goal is to help you learn how to invest and achieve financial independence.